Why Gold and Silver?

There are a ton of reasons why people choose to invest in gold and silver. We don't provide financial advice, but here are a few that we hear in our store:

This decision will depend on your budget and your desire to transport your bullion. One ounce of gold will cost roughly 90 times the cost of an ounce of silver. This can be a blessing and a detriment.

Gold is comparatively expensive. A gold one ounce coin (about double the size of a quarter) would be roughly $2000. This means it is extremely transportable. $100,000 of gold easily fits in a pocket or a purse. The detriment to this is you must sell $2000 dollars at a time. If you need $300 dollars in cash, you cannot trade in 1/4 of your coin.

Silver is comparatively inexpensive. As of June of 2019, a silver one ounce coin (about twice the size of a quarter) would be approximately $16. This means that it grows in size quickly. $100,000 of silver would be 6,250 ounces and 13 large boxes and would weigh more than 430 pounds. The benefit is that you can sell and buy individual pieces. For $16 you can buy an ounce of silver or sell it for cash. It makes it easily divisible.

For most people, diversifying into both makes a lot of sense. It provides the means to liquidate some, while also keeping down on storage size, weight and the overall bulk! It is combining the benefits of both, or getting the best of both worlds!

Come on down and see us! We DO NOT ship gold and silver. We also cannot accept credit / debit cards. We cannot accept more than $10,000 in cash (federal law). We can accept smaller amounts of cash, as well as certain types of cashier's checks made out to us. Call us ahead of time to find out more.

Our location / Contact UsExplore our diverse selection of gold coins, each with its own unique attributes and investment potential. From classic favorites to modern treasures, find the perfect gold coin to enhance your collection or investment portfolio.

Gold Eagle

The American Gold Eagle, renowned for its iconic design and purity, is a top choice among collectors and investors alike.

Gold Maple Leaf

Canada's Gold Maple Leaf stands out for its 99.99% purity and its famous maple leaf design.

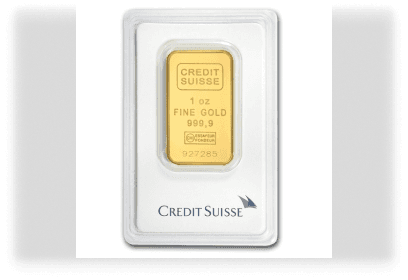

Gold Bar

Gold bars offer a straightforward investment in gold bullion, with varied weights for different investment levels.

Gold Krugerrand

Originating from South Africa, the Gold Krugerrand is prized for its durability and gold content.

Gold Philharmonic

Austria's Gold Philharmonic coin celebrates Vienna's musical heritage, making it a unique collector's item.

Gold Buffalo

The American Gold Buffalo boasts a 99.99% gold purity and features a classic American buffalo design.

Gold Kangaroo

Australia's Gold Kangaroo is popular for its unique kangaroo motif, which changes yearly.

Gold Panda

China's Gold Panda is sought after for its annually changing panda designs and .999 gold purity.

Explore our diverse selection of silver coins, each with its own unique attributes and investment potential. From classic favorites to modern treasures, find the perfect silver coin to enhance your collection or investment portfolio.

Silver Buffalo

Our most popular investment silver, privately minted high purity silver rounds with a design that pays homage to the native history of the United States.

Silver Eagle

The American Silver Eagle, celebrated for its elegant Liberty design and 99.9% silver purity, is a favorite among collectors and investors.

Silver Maple Leaf

Canada's Silver Maple Leaf is renowned for its 99.99% silver purity and its classic maple leaf design, symbolizing Canadian heritage.

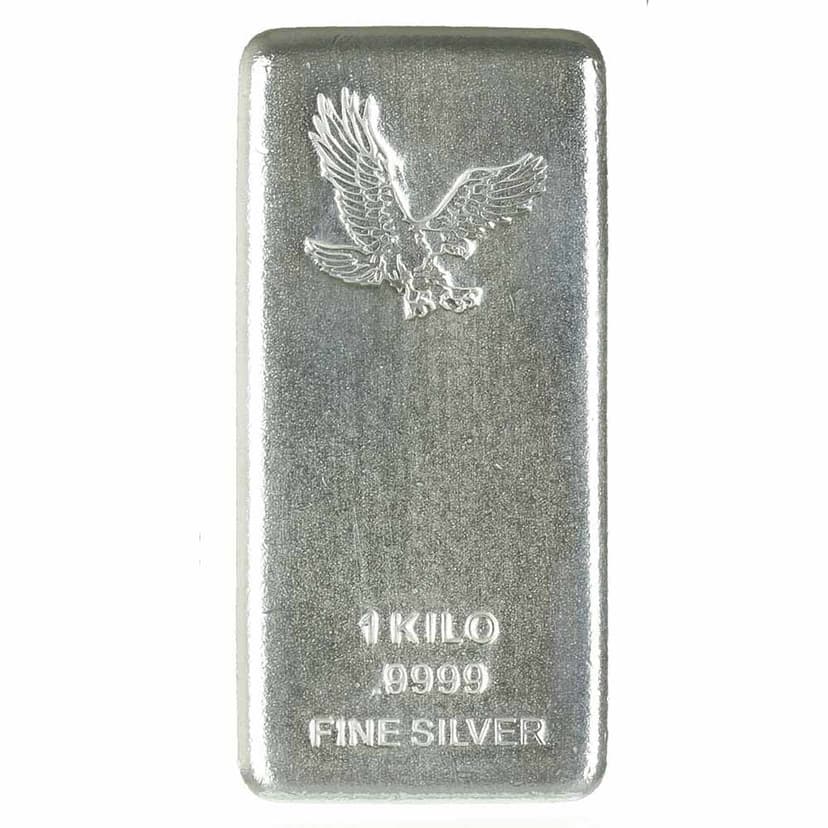

Silver Bar

Silver bars are a popular choice for investing in silver bullion, offering flexibility in investment with various weights.

Silver Krugerrand

The Silver Krugerrand from South Africa is known for its striking portrayal of the Springbok and its fine silver content.

Silver Philharmonic

Austria's Silver Philharmonic coin is a tribute to the Vienna Philharmonic Orchestra, making it a unique piece for collectors.

Silver Kangaroo

Australia's Silver Kangaroo coin is admired for its annually updated kangaroo design and fine silver quality.

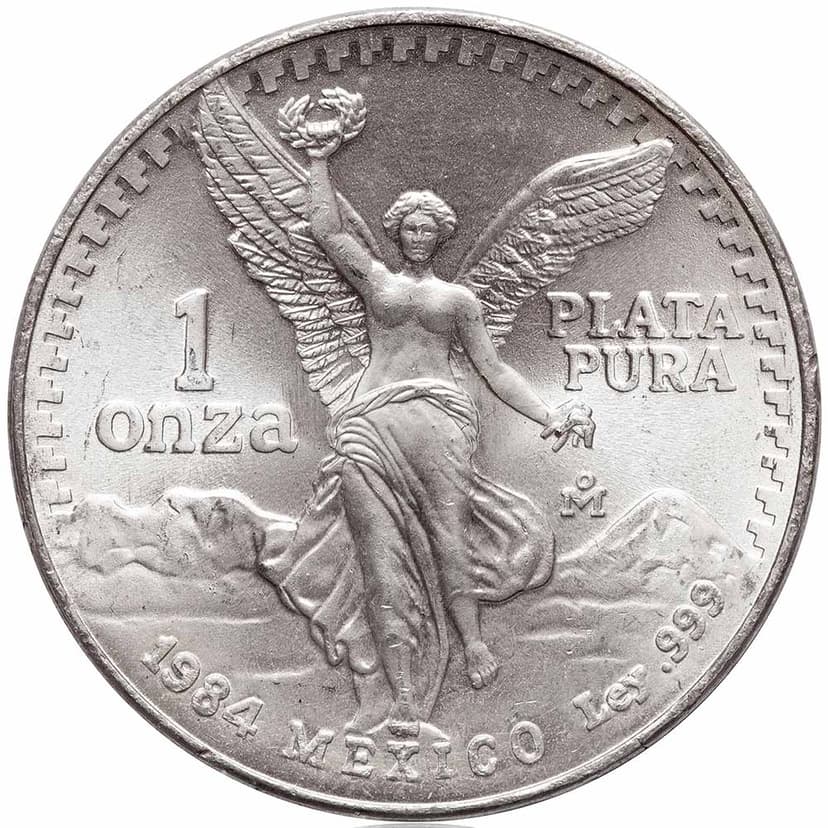

Mexican 1 Onza

The Mexican 1 Onza silver coin is prized for its intricate design featuring the national coat of arms and its .999 fine silver content.